Some Known Questions About Insurance Code.

Wiki Article

Getting The Insurance Expense To Work

Table of ContentsThe Basic Principles Of Insurance Quotes The Best Guide To Insurance CommissionThe Buzz on Insurance Ads10 Easy Facts About Insurance Account Described4 Easy Facts About Insurance Asia ShownNot known Facts About Insurance Advisor

Handicap insurance can cover long-term, momentary, partial, or total handicap. It does not cover medical treatment and also solutions for long-lasting care.

Life Insurance Policy for Kids: Life insurance policy exists to change lost earnings. Accidental Fatality Insurance Coverage: Even the accident-prone ought to skip this kind of insurance.

It's finest to take a stance someplace in between these two mindsets. You need to certainly take into consideration buying all or many of the 5 required kinds of insurance coverage mentioned above. These are one of the most crucial insurance kinds that provide massive economic alleviation for very practical scenarios. Beyond the 5 primary types of insurance coverage, you must assume thoroughly prior to getting any extra insurance coverage.

Getting My Insurance Code To Work

Bear in mind, insurance policy is suggested to protect you and also your financial resources, not injure them. If you need assistance with budgeting, attempt making use of a costs payment tracker which can assist you preserve all of your insurance policy repayments so you'll have a much better grasp on your personal financial resources. Related From budget plans as well as bills to cost-free credit report as well as more, you'lldiscover the uncomplicated way to remain on top of all of it.There are numerous insurance coverage choices, and also lots of economic experts will state you need to have them all. It can be hard to determine what insurance you really need.

Factors such as kids, age, way of life, and also work advantages play a role when you're developing your insurance coverage portfolio. There are, nonetheless, four kinds of insurance policy that the majority of economic professionals suggest we all have: life, health, car, and lasting special needs.

What Does Insurance Mean?

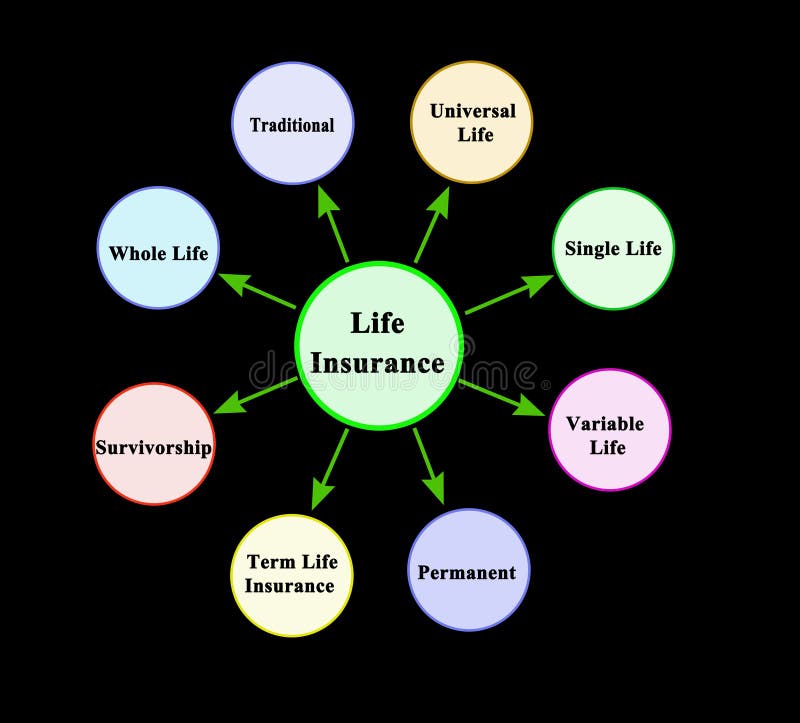

The 2 standard kinds of life insurance policy are standard whole life and also term life. Merely described, whole life can be utilized as an income tool in addition to an insurance policy tool. As long as you remain to pay the monthly premiums, entire life covers you up until you pass away. Term life, on the various other hand, is a plan that covers you for a collection quantity of time.

Usually, even those employees that have terrific medical check here insurance, a nice nest egg, and a great life insurance plan do not prepare for the day when they may not be able to benefit weeks, months, or ever before again. While health and wellness insurance policy spends for hospitalization and also clinical costs, you're still entrusted those day-to-day expenses that your income typically covers.

Insurance Expense - The Facts

Lots of companies offer both brief- and long-term disability insurance as part of their advantages package. This would certainly be the very best alternative for protecting affordable impairment insurance coverage. If your company doesn't supply long-lasting insurance coverage, below are some things to take into consideration prior to purchasing insurance coverage on your own. A policy that assures earnings replacement is ideal.7 million automobile accidents in the U.S. in 2018, according to the National Highway Web Traffic Safety And Security Management. An approximated 38,800 individuals passed away in auto accident in 2019 alone. The number one cause of fatality for Americans between the ages of 5 and 24 was car mishaps, according to 2018 CDC information.

7 million vehicle drivers and also guests were injured in 2018. The 2010 economic prices of auto accidents, including deaths and disabling injuries, were around $242 billion. While not all states call for vehicle drivers to have auto insurance, many do have guidelines pertaining to economic duty in case of a crash. States that do call for insurance policy conduct routine arbitrary checks of motorists for evidence of insurance policy.

A Biased View of Insurance Ads

If you drive without car insurance as well as have a mishap, penalties will most likely be the least of your economic concern. If you, a passenger, or the various other chauffeur is injured in the accident, automobile insurance will cover the costs and also help guard you against any type of litigation that may arise from the mishap.Once more, similar to all insurance, your private circumstances will certainly figure out the expense of auto insurance coverage. To ensure you obtain the right insurance for you, compare numerous price quotes and the coverage provided, and also check regularly to see if you receive reduced prices based upon your age, driving document, or the area where you live (insurance account).

Constantly examine with your company first for available protection. If your company doesn't provide the kind of insurance policy you want, obtain quotes from several insurance coverage carriers. Those who provide coverage in multiple areas might supply some price cuts you could try here if you acquire even more than one kind of coverage. While insurance is costly, not having it can be much more pricey.

The Basic Principles Of Insurance Companies

Insurance coverage resembles a life coat. It's a little a nuisance when you don't need it, but when you do need it, you're greater than happy to have it. Without it, you can be one car wreck, illness or residence fire far from drowningnot in the sea, yet in debt.Report this wiki page